Table of Content

For an idea on how a lender will react to your income, you can figure out your debt-to-income ratio. The number includes your monthly debts and what you would take on with a new home, divided by your monthly income. By checking this number yourself, you can get an idea of your budget when searching for a home and applying for loans.

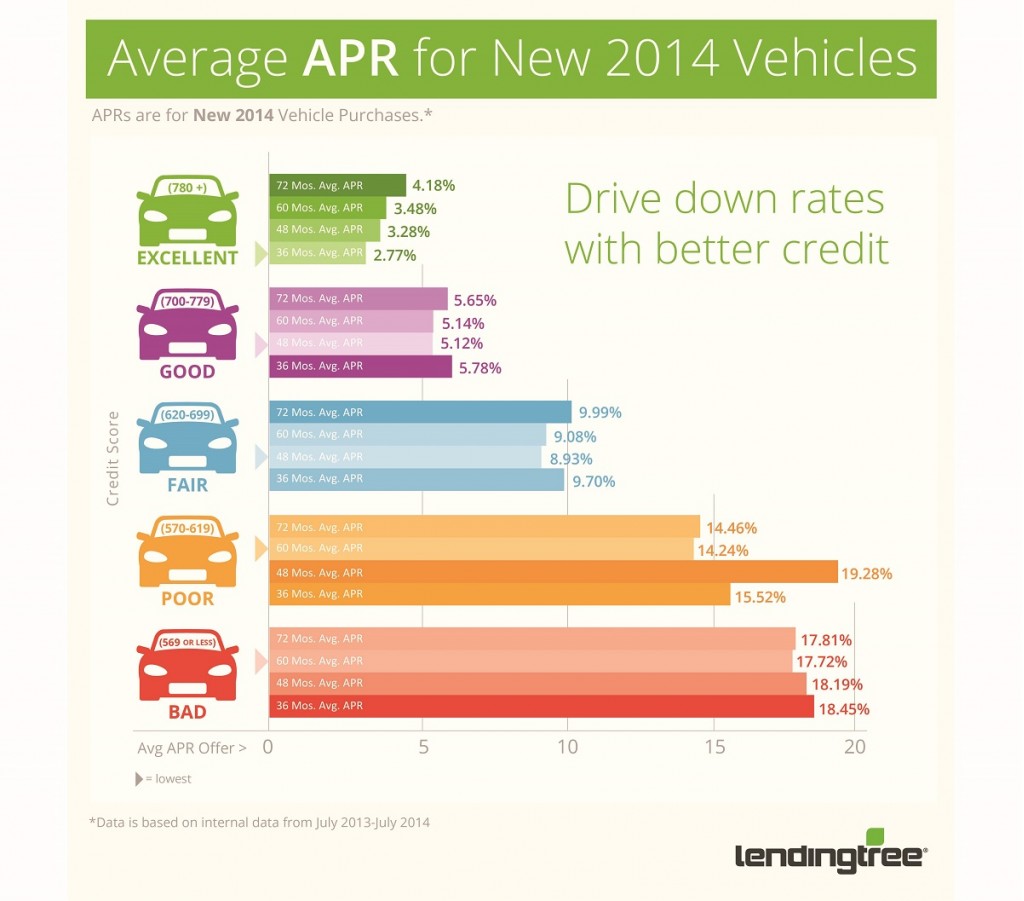

Your credit history and score determine the most significant factor in getting the perfect mortgage rate. Acredit score reflects financial behavior, from payment history to debts and the age of your credit. Lenders look at your credit history to verify that you can repay the mortgage promptly. The sweet spot is around 660, with excellent credit being anything above 700. Depending on your new real estate market, you could be spending far less on a mortgage payment.

Is now a good time to buy a house?

This means that even if interest rates fluctuate, your rate will stay constant. Your income is another important factor when lenders determine if you’re eligible for a mortgage. To determine if you qualify, lenders evaluate your income and other assets, such as investments. In addition to economic and political factors and the influence of the Fed, your unique financial situation will help determine the mortgage rate you qualify for. Because your interest rate is the cost you pay to borrow money, it makes sense that you’ll want to strive to get the lowest rate possible. Even a slight difference can significantly affect the amount you’ll pay over the life of a loan.

Maurie Backman writes about current events affecting small businesses for The Ascent and The Motley Fool. Meanwhile, if a recession hits, it could result in widespread unemployment. And that could push more buyers out of the market, thereby narrowing the gap between supply and demand even if real estate inventory holds steady. If you’re considering a 15-year mortgage, there are some pros and cons to keep in mind.

How to find a good mortgage rate

While this may sound appealing, you need to tread carefully, as you’ll then pay interest on this over the duration of your mortgage term . Adding the cost of stamp duty to your loan will also mean you’re borrowing a larger amount. The best rate on a fixed rate buy to let mortgage this month is a 2 year fix from The Mortgage Works at 4.29%. You’ll need a deposit of 35% and it has a rather hefty arrangement fee of £3,750.

Credit report agencies will assign you a credit score by evaluating these factors. The most common model is the FICO® credit score, which ranges from 300 to 850. Here are a few key factors lenders will consider when determining your rate. In March 2020, citing disruption caused by the coronavirus outbreak, the Fed cut the federal funds rate—the benchmark for most interest rates—to nearly zero. For the next decade, the Fed kept interest rates very low to encourage borrowing and reinvigorate the economy.

How to Ensure You Get the Best Refinance Rate

While a home equity loan is a low interest rate financing option, it's not without risk. When you secure the loan, your home acts as collateral, which means you could lose your home if you're unable to repay what you borrowed. It's important to carefully consider whether a home equity loan is right for you before applying for financing. Like buying a car, if you’ve got a score of 670 or higher, you’ll likely be able to lease a car, assuming other aspects of your financial profile like your income and debt levels are solid, says Channel.

When researching mortgage options, borrowers may notice interest rates listed on lender websites and assume this is the rate they would get with that specific lender. This will make it easier for home buyers to get an idea of what their mortgage payments would actually look like with each lender. Borrowers can do an online search for “prime interest rate today” to see what the ideal interest rate might look like for various lenders. There are several factors lenders consider in addition to credit score and debt-to-income ratio when it comes to determining a borrower’s mortgage rate.

Having a higher credit score, a larger down payment, a low DTI, a low LTV, or any combination of those factors can help you get a lower interest rate. Though the Fed does not directly set mortgage rates, the central bank's policy actions influence how much you pay to finance your home loan. If you're looking to buy a house, keep in mind that the Fed has signaled it will continue to raise rates into 2023, which would likely continue to drive mortgage rates upward.

The biggest advantage to a 30-year mortgage is the ability to spread loan payments out over the maximum amount of time. That keeps the monthly payment much more affordable and makes homeownership accessible to more people. Find out if a 30-year fixed-rate mortgage is the right type of home loan for you and compare current rates for 30-year mortgages. When you apply for a mortgage, the lender will review your credit to determine your creditworthiness as well as your interest rate. In general, the higher your credit score, the better your rate will be. To get an idea of where you stand, check your credit before you apply and dispute any errors with the appropriate credit bureau to potentially boost your score.

At the current average rate, you'll pay principal and interest of $632.73 for every $100,000 you borrow. The average rate for a 30-year fixed mortgage is 6.51 percent, down 9 basis points from a week ago. Last month on the 23rd, the average rate on a 30-year fixed mortgage was higher, at 6.78 percent. You can save thousands of dollars over the life of your mortgage by getting multiple offers.

But one that caters to super-prime borrowers likely won’t give you the time of day. Shopping around for a mortgage rate means applying with multiple lenders and getting personalized quotes. It does not mean simply looking online and picking the lender with the lowest advertised rates. At the time this was written in Nov. 2022, the average 30-year fixed rate was 6.61% according to Freddie Mac’s weekly survey.

No comments:

Post a Comment